Preparing for A Housing Crash

What We Can Learn From

Toronto’s Largest Real Estate Crash

This isn’t the first time we’ve looked at the Toronto real

estate crash of 1989, but we came across two charts we found very insightful,

and we’d like to share. First, we recently saw a headline in The Financial Post, Is

Canada’s middle class shrinking — or does It just feel that way? Anything to do with the middle class tends to grab our

attention. However, upon reading the article, there was one line that really

bothered us, “A recent poll conducted by

Ekos Research for The Canadian Press suggests fewer than half of all Canadians

now identify as members of the middle class — a steep drop from nearly 70 per

cent in 2002.” A 20% drop in the middle class in 15 years! This should be making front page news. The middle class in

Canada is being destroyed at a rapid rate, and we need to do something about

it. The only two ways we know to circumvent this trend is to get

yourself some hard assets, like good income-producing properties, or start your

own small business. We’re big believers in both of these strategies. There are obvious risks involved in both strategies, but no

one ever got ahead without some sort of risk. That being said, do what you can

to be prepared for the risks involved. One of the largest perceived threats,

which keeps many from investing in income-producing properties is a market

crash. “What happens if I buy at the top of the market and things

drop after closing?” This is a question on a lot of people’s minds right now. The

real estate market was so hot for so long, but since new mortgage rules came

into effect in the spring of 2017, and then the new stress test at the

beginning of 2018, there has been a big question mark hanging over the market. There’s concern that we may be looking at a drop in the

market, and no one knows how great of a drop that would be if it happened, and

how long the market would be down. We can’t predict the future, but we can look at the past to

make an educated prediction of what a potential crash could look like. So, we want to dive deep into that topic and go

back to look at the Toronto’s largest real estate crash so we can learn from

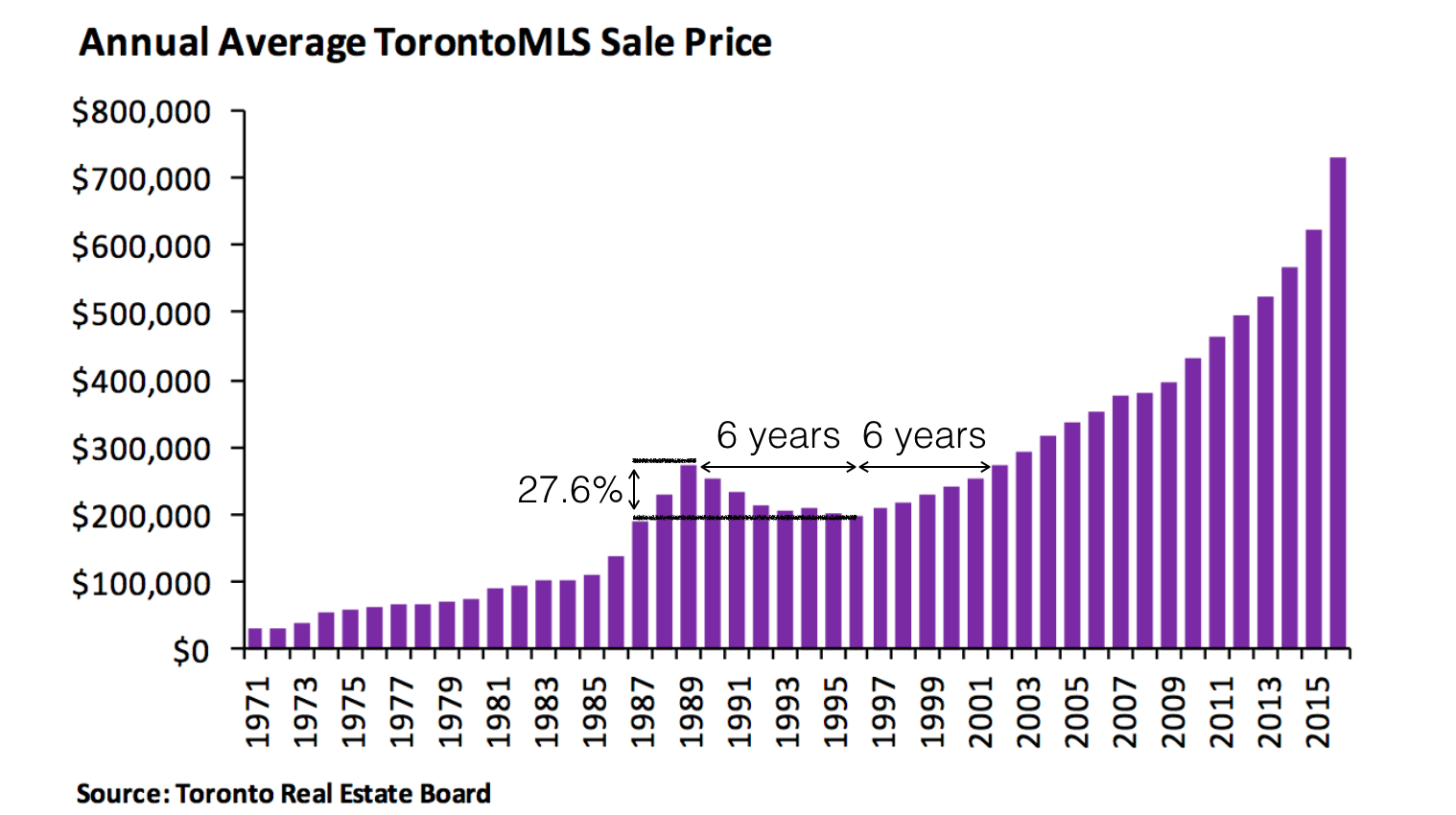

it. This chart looks at the average annual sale price of homes

in Toronto from 1971 till 2016, but we’re focusing on the centre of the graph. If you go back to 1989-1990, you can see the peak pricing of

the Toronto real estate market before the crash. Prices then fell for 6 years,

levelling off in 1996. In those 6 years, prices dropped 27.6% on average.

Prices, at their lowest, were at the same point they were at in 1987, only 2-3

years before the crash began. Now, what most homeowners want to know, the recovery time.

It took 6 years (1996-2002) for prices to go from the bottom of the crash back

to where they were prior to the drop. That means if you bought at the peak,

before the “bubble burst,” it took 12 years on average for your property to be

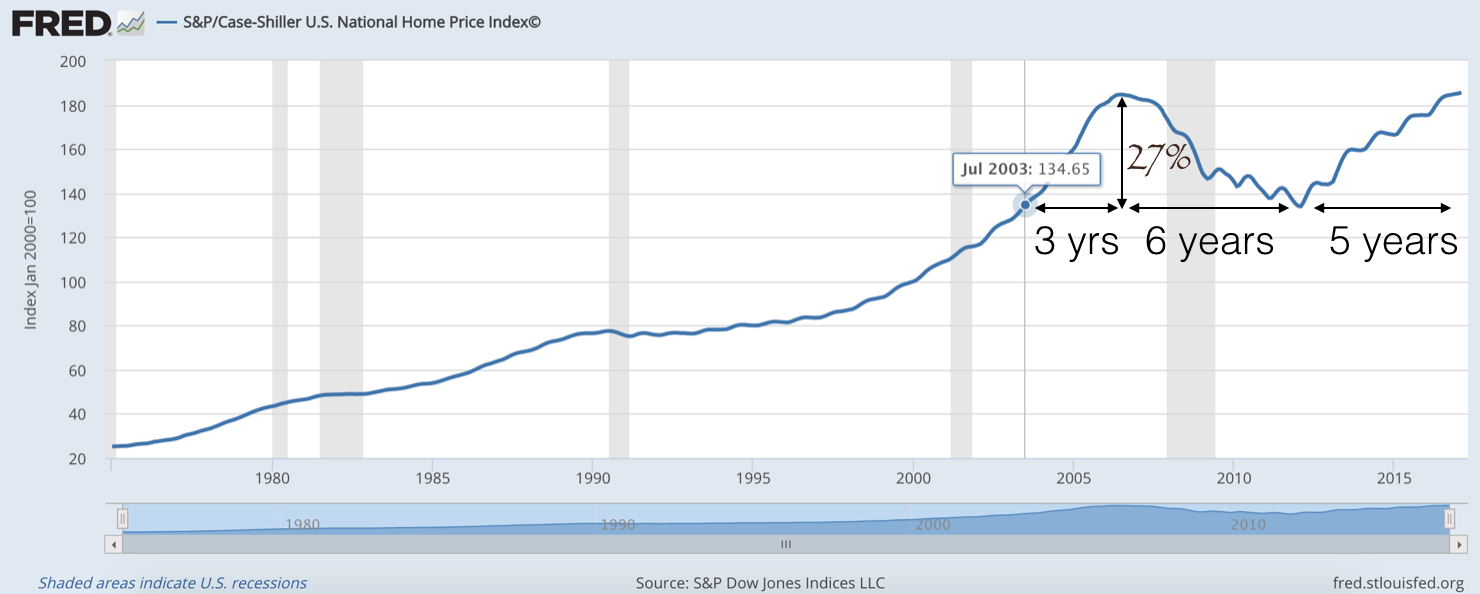

at the same dollar value as when you purchased. Now, let’s look at another example. When thinking about market corrections, it’s hard to ignore

the market crash of 2007 in the United States. This crash didn’t have a major

effect on the Canadian housing market, but it is another good historical

example of what a major market crash could look like. If you look at US prices, it took about 6 years from the

start of the “crash” for prices to bottom out. This is interesting to us. This

happened 17 years after the crash in Toronto, and in a different country, yet

both crashes took roughly the same time for prices to bottom out. The average price depreciation in the United States was also

27% over those 6 years. It is important to note that these are national

averages. Some areas saw far greater losses, and some only saw a small dip in

the market. In the United States, prices fell to the price they were 3

years before the crash. It took 5 years for them to go back up, for a total of

11 years for the market to fully restore itself. It’s striking how similar the Toronto crash of 1989 and the

U.S. housing crisis of 2007 are to one another. It gives us some a sense of

assurance that if/when the market corrects itself, prices will likely drop over

several years, but the market will bounce back eventually. We are still big believers in income-producing properties.

If you can find a property that produces positive monthly cash flow (more money

coming in from rent than the monthly expenses), you have the flexibility to

ride out dips in the market. Whether it takes 5 years, 12 years, or 20 years,

you have an asset that is generating income for you, all while someone else is

paying off the load. Seems like a solid choice to us. Some Cool Free Stuff... Step 1: Grab a free digital copy of our real estate investing book, Income For Life For Canadians, right here. This book has been downloaded over 22,597 times and has helped hundreds of investors kick-start their investing with simple and straight forward strategies that you can implement right here in Canada. You'll also receive our weekly [Your Life. Your Terms.] email newsletter with the latest investing updates and videos. Step 2: Free Weekly Investing Videos & Articles: Get the latest updates and join the over 10,000 other Canadians enjoying the weekly [Your Life. Your Terms.] email newsletter. The email is sent out each Thursday. And as a little bonus we'll give a FREE digital copy of the book, Income For Life For Canadians, too! Your Life. Your Terms. Step 3: Free LIVE Investing Class: Do you live in the Greater Toronto or Golden Horseshoe Area? Come out to our next introductory "Investing in Nice Homes in Nice Areas" Real Estate Class. It's 90-minutes and you'll learn a ton - promise!Thousands of investors have now joined us for this class and the feedback has always been amazing.